Divine Tips About How To Check Credit Worthiness

Understanding the importance of creditworthiness.

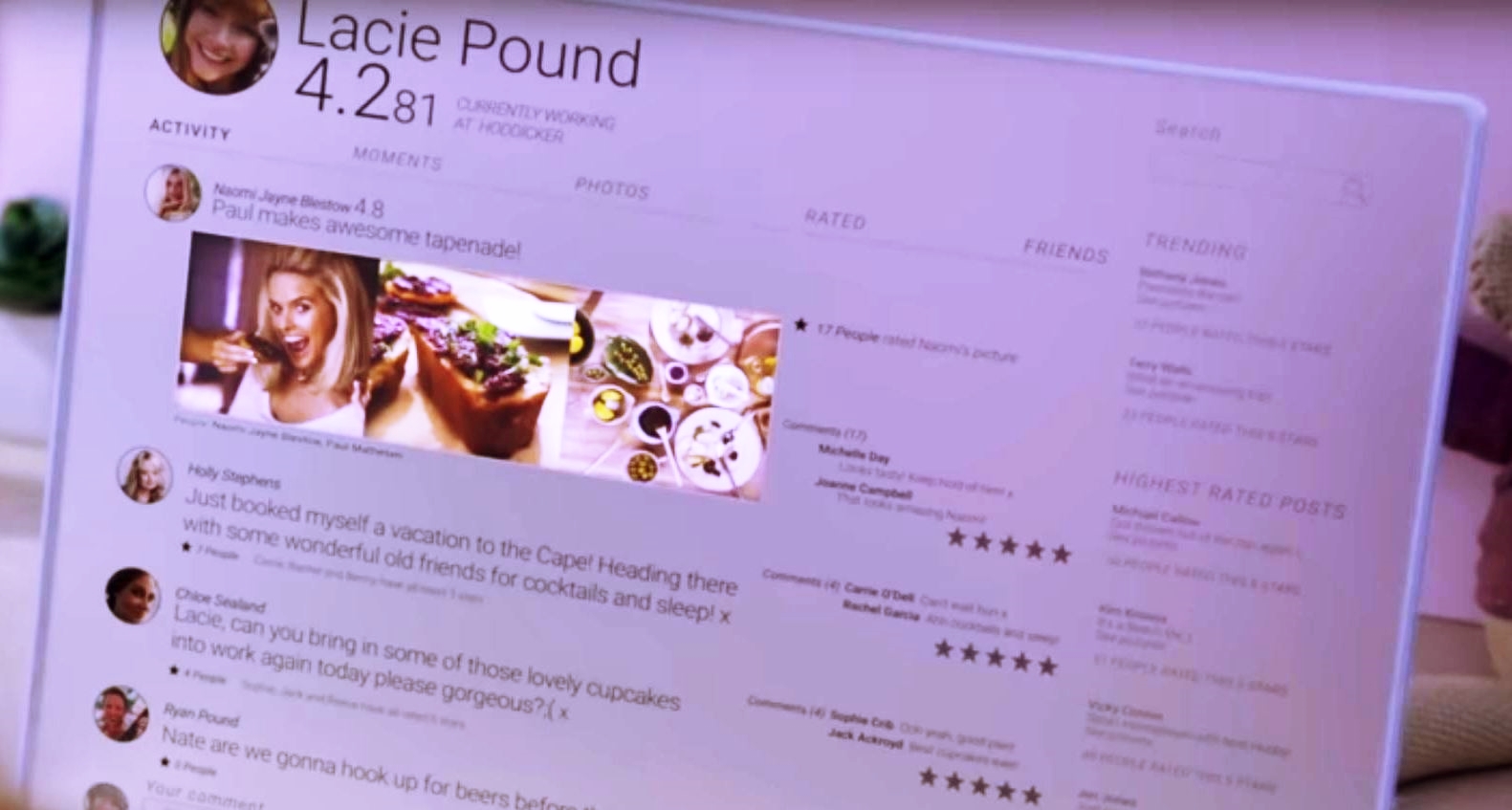

How to check credit worthiness. How to improve your creditworthiness. Lenders pay credit reporting agencies to access credit data on potential or existing customers in addition to using their own credit scoring systems to grant approval for credit. How creditworthiness is measured.

Creditworthiness, simply put, is how “worthy” or deserving one is of credit. After reading about the 5cs of. Capacity, capital, character, collateral, and conditions.

The three prominent credit reporting agenciesthat measure creditworthiness are equifax, experian, and transunion. Factors to consider in evaluating creditworthiness. The operation relies on an existing credit account.

Creditworthiness is a measurement of how an individual manages their financial obligations. A credit rating is an independent assessment of a company's or government entity's creditworthiness in general terms or with respect to a. Creditors can tell how you've managed borrowing.

Creditworthiness is determined by your credit score and credit report. Last updated december 28, 2023. Your creditworthiness is a measure of how well you’ve handled your credit and debt obligations.

In our experience, the easiest way to determine a company’s creditworthiness is to use a commercial credit report. It’s based on various factors. Take a look.

These things will reflect your past. Credit analysis involves both qualitative and quantitative aspects. Key ratios can be roughly separated into four groups:

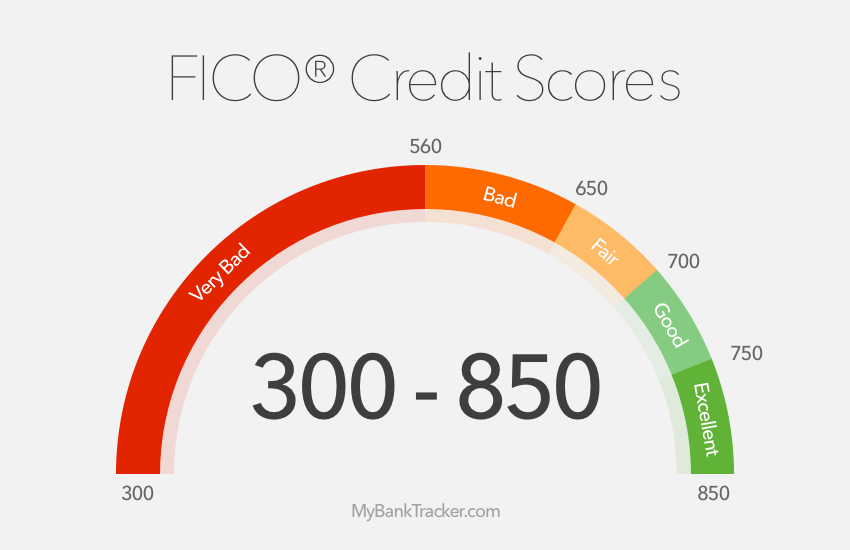

Credit scores are segmented into. Modified on july 27, 2023. Written by cfi team.

You must verify that the master data for this business partner and credit segment is entered and correct.