Amazing Tips About How To Develop A Budget

If you prefer to operate in the 21st century, there are numerous apps to help you track your new budget.

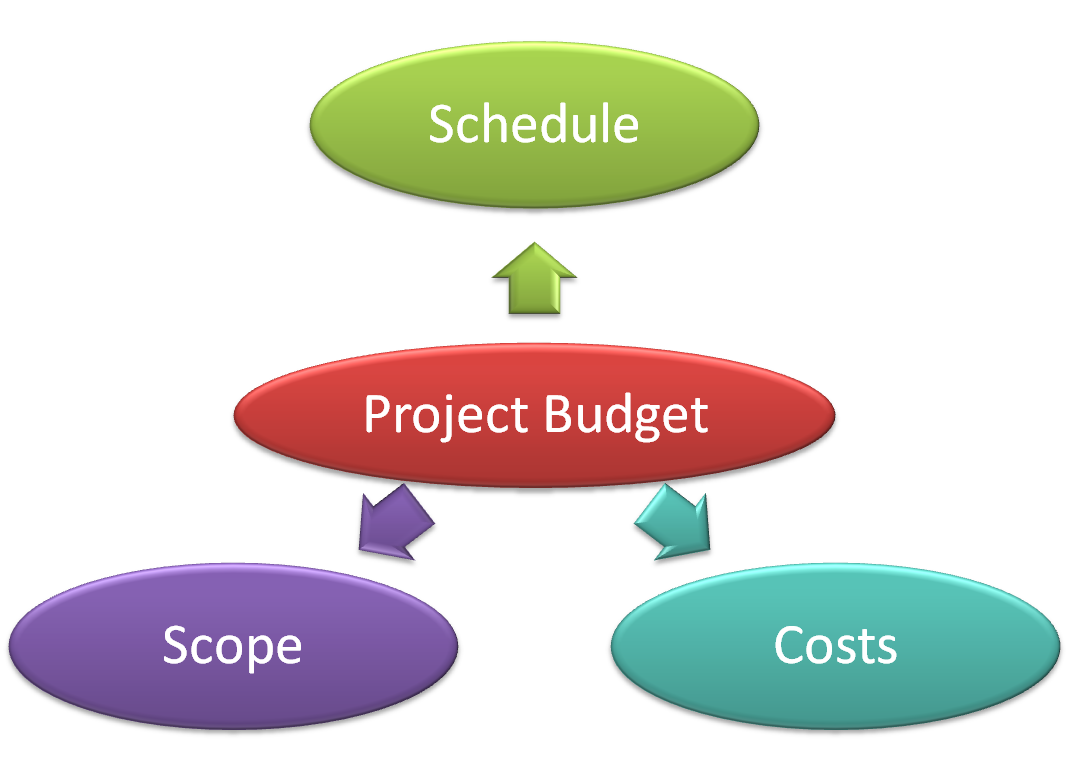

How to develop a budget. When should you develop the budget? We can then make changes along the way to ensure that we arrive at the desired goals. How to make a project budget:

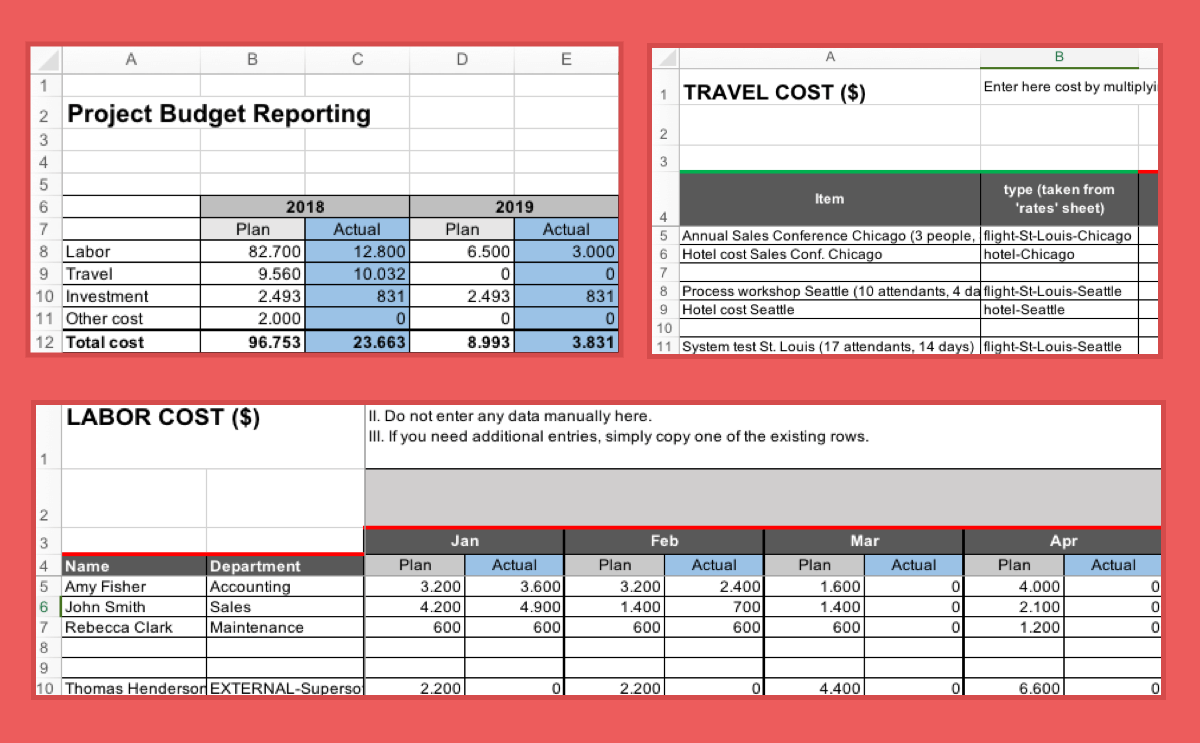

Before you compile your budget, it’s important to have a firm understanding of. With the fourth deficit in five years being estimated to be over hk$100 billion (us$12.8 billion), chan is expected to deliver measures to boost government incomes, cut expenditures and develop. Project budgeting basics (templates included) by jennifer bridges | may 10, 2023 make a project budget and stick to it with projectmanager.

There is no one way to budget. Determine which of your life goals require money and how much you realistically need to meet them. This will give everyone involved in the process the.

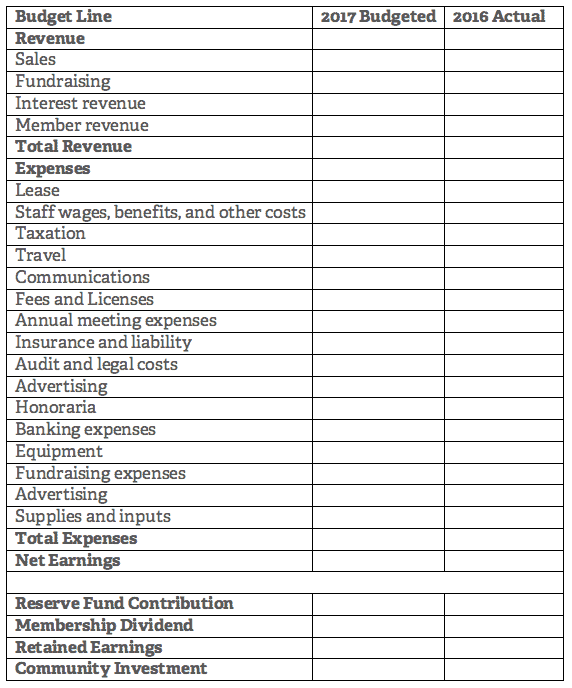

This is not your gross income. If you have money left, you have a surplus. How to create a business budget:

Define goals before embarking on your budget, clear objectives must be specified and communicated transparently to every. In its simplest form, a budget plans for and compares income and expenses over a specified time period. So what are the crucial strategies when preparing a budget?

Many people leave the development of a budget as one of the last tasks. How to make a budget in 5 steps step 1:

How to create a budget in 5 steps. 4 hours ago 18 mins. Estimate your income for the period covered by the budget.

We’ve laid out each part of the budgeting process below. If you don't have a regular income, work out an average amount. Once you’ve embraced the realities of the budgeting process, you’re ready to.

It allows you to set a spending target and alerts you to progress throughout the month. Gdp growth is projected to increase from an estimated 0.6 per cent in 2023 to average 1.6 per cent between 2024 and 2026.

Calculate your net income the first step is to find out how much money you make each month. Create a budget using the 50/30/20 rule to split your income between needs, wants, savings and debt repayment. Set project objectives project objectives are what you plan to achieve by the end of your project.