Best Of The Best Info About How To Get Out Of The Payday Loan Trap

I began to take out 1 or 2 payday loans at a time.

How to get out of the payday loan trap. Payday loans can seem like quick fixes when you need cash fast. Plus, cash advance options for if you're a gig worker. Best for small loan amounts:

But they often create a vicious cycle of debt that’s hard to escape. If you’re stuck in a cycle of applying for payday loans to get to your next paycheque, you might benefit from a debt consolidation loan. While they are convenient, these loans charge exorbitant interest rates (according to one study, typical interest ran.

Discover essential tips to borrow responsibly, avoid debt traps, and stay financially sound. Amazon, google, microsoft and paramount, are among a long list of companies with recent layoffs. From loans that don’t require a credit check to those secured by collateral, understanding the differences between these five options will help you make the best.

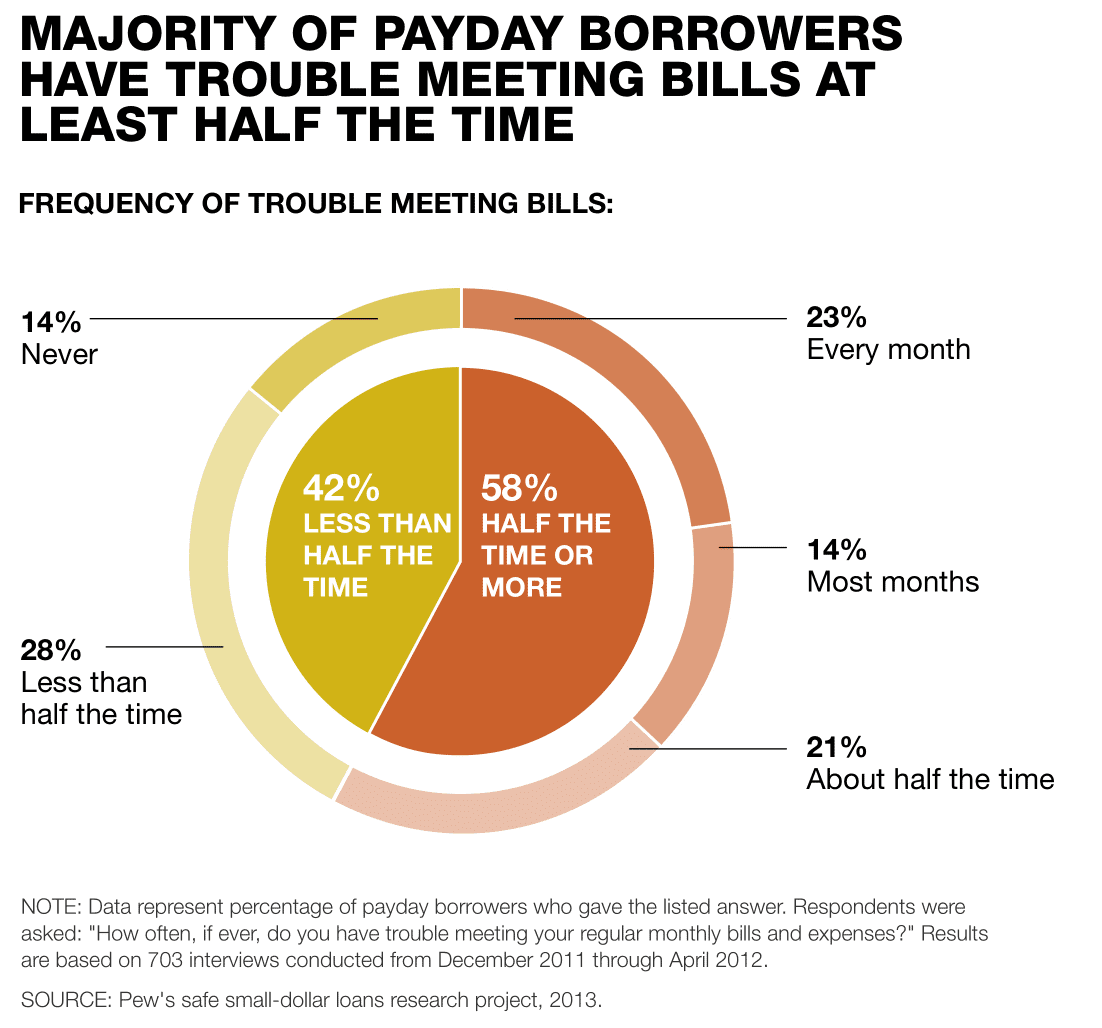

I would pay them back, and it wasn’t out of control. Our report found that families who had taken out a payday loan within the past year: This may be the only time in your life when anyone suggests that you take out a credit card cash advance.

We look at how to do it. The faster you pay off the debt,. Join me as we tackle payday loan debt trap the smart way.

Tips to avoid payday loan debt traps. There are a lot of apps to borrow money from out there. But in january 2005, both my boyfriend and i had our credit.

If you've taken out a payday loan and are now trapped in a cycle of increasing debt, your situation may seem bleak, but there are options that can help you. Tend to have less income, lower wealth, fewer assets, and less debt than.

Is it possible to get ahead of the payday loans and get credit back in good standing? Many of those unemployed workers are now trying to. 6 best payday lenders: