Outrageous Info About How To Handle Medical Debt

According to david reischer, esq., bankruptcy attorney & ceo of.

How to handle medical debt. Budgeting managing your debt how (and where) to get medical debt relief learn the best ways to get help with medical bills by justin pritchard updated on. Health care debt does not have to be enormous for people to have problems paying it off, though some do report owing large amounts. Talk to the hospital or your insurance provider as soon as possible.

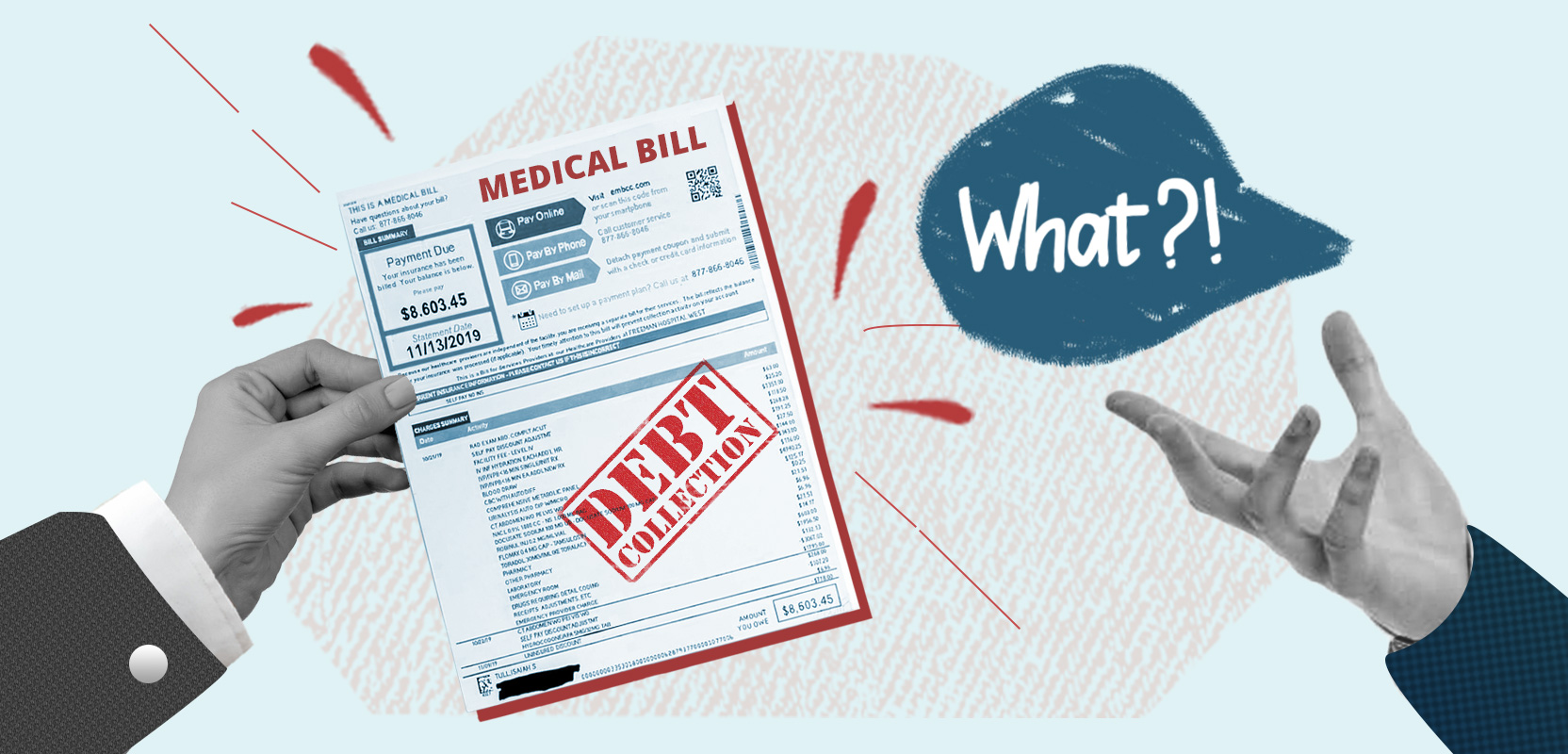

Unpaid medical bills can end up in collections. They don’t choose to get ill or. Paying by credit card shifts the debt away from the hospital — where your bills may have a low interest rate or even none at all — and into a.

Don't put medical debt on a credit card. Make sure you really owe the money medical bills are notoriously inaccurate. The best way to handle medical debt is to deal with it right away.

Make sure the money owed is listed as medical debt. Review your bill closely it can be tempting to shove a large bill into the trash in frustration. When you’re dealing with a medical emergency, it’s hard not to see dollar signs every time you visit the urgent care center or emergency.

People choose to take a loan to buy a car; About half of adults with. If your medical bill goes to.

Written by angela mae watson published on november 16, 2022 key takeaways: Gather your outstanding bills this can be one of the most difficult parts. While some scores don’t treat medical debt as harshly as others do, lenders tend to use one that treats all debt in collections the same if it appears on your credit.

According to one widely published report, 80% of bills contain one or more. Unpaid healthcare bills can lead to serious financial consequences — and even poorer health. Avoiding treatment because of financial concerns can be dangerous—there are ways to manage medical debt and still receive the care you need.

Pay your medical bills right away. Find every bill from each of your providers and put them all in one place. Tips if you can’t pay your medical bills.

For example, a 2022 analysis by the consumer financial protection bureau found that 32.7% of those age 25 to 34 reported having medical debt, as did 30.1% of. The new changes from the medical bureaus keep only unpaid medical bills out of your credit report, not. Financial institutions and lenders treat medical debt differently than unpaid consumer bills.

A doctor may order blood tests for a patient.

-min.png?format=1500w)